The Ultimate Guide to Flex Space in the DC-Richmond Corridor

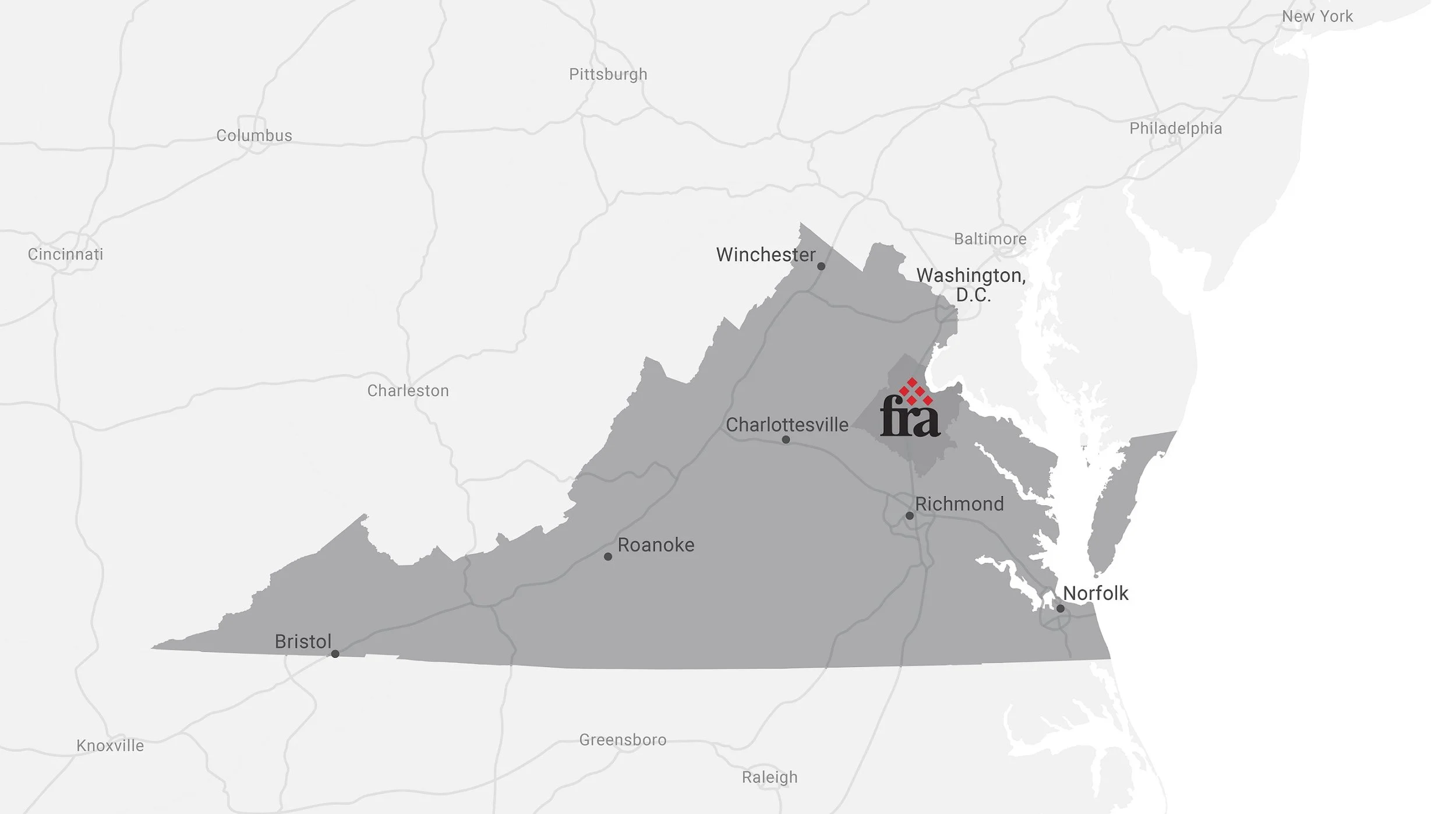

Image borowed from the Fredericksburg Regional Alliance.

Why Flex Space is the Hottest Ticket in the DC-Richmond Corridor. For market updates and more information, please follow us on LinkedIn.

Welcome to the definitive guide to flex space in one of the nation's most dynamic commercial real estate markets. The corridor connecting Washington, D.C., and Richmond, VA, is experiencing unprecedented growth, creating a powerful and urgent opportunity for businesses and investors. The Fredericksburg region, strategically located at its center, has been the fastest-growing region in Virginia for five consecutive years. Its population has surged 21.7% since 2010 and is projected to grow another 20% by 2030.

But this isn't just a story of population growth. A massive boom in data center development is fundamentally reshaping the landscape. With over 9,900 acres in the region planned or under construction for data centers, viable industrial sites are being rapidly consumed. This land rush is creating a critical squeeze on light industrial and flex space. As a result, warehouse rental rates have climbed 17.3% year-over-year , while vacancy rates in key submarkets like Spotsylvania have plummeted below 3%.

Demand is dramatically outpacing supply, making it a landlord's market and a golden opportunity for those who can secure a spot. In this guide, we'll cover everything you need to navigate this lucrative market, including:

What Flex Space Is: A breakdown of its unique, hybrid characteristics.

A Deep Dive into the I-95 Corridor: Analyzing the market forces creating this historic opportunity.

Exploring Other Key Submarkets: A look at the Dulles Tech Corridor and Richmond's Scott's Addition.

Understanding Lease Structures: Demystifying common lease types like NNN and Gross.

Ideal Tenant Profiles: Exploring the types of businesses that thrive in these spaces.

The Path Forward: How you can capitalize on the demand for flex space in the DC-Richmond corridor.

What is Flex Space? The Swiss Army Knife of Commercial Real Estate

Flex space is exactly what it sounds like: a highly adaptable type of commercial property that combines multiple uses under one roof. Think of it as a hybrid, typically blending office, warehouse, and light industrial capabilities.

Key Characteristics:

-

Usually includes a finished office area at the front for administrative tasks, meetings, or a customer-facing showroom. This typically makes up 15-40% of the total square footage.

-

The back portion features open, high-ceiling space for storage, R&D, light assembly, or distribution.

-

Features one or more grade-level (drive-in) or dock-high (truck-level) overhead doors.

-

Often found in the "small-bay" category, typically under 5,000 square feet.

This versatility makes it the perfect solution for businesses that have outgrown a storage unit or home office but don't need—or can't afford—a massive, single-purpose warehouse or a standalone office building.

Market Spotlight: The I-95 Corridor (Fredericksburg, Stafford & Spotsylvania)

The Fredericksburg region is the epicenter of this opportunity. Situated perfectly halfway between Washington, D.C., and Richmond, it offers businesses strategic access to more than 60% of the nation's population.

-

The region's population has surged over 21% since 2010 and is projected to grow another 20% by 2030, making it the fastest-growing area in Virginia for five straight years. With a current population of nearly 400,000 and access to a skilled labor force of over 1 million within a 40-mile commute, the economic fundamentals are incredibly strong.

-

Northern Virginia is the largest data center market in the world, but it's now saturated, with a vacancy rate below 1%. This has pushed developers south. As a result, the Fredericksburg region is poised for a tidal wave of data center development, with over 9,900 acres planned or under construction.

Giants like Amazon Web Services, Google, Facebook and OpenAI are investing billions in massive new facilities in counties like Stafford. While this brings tax revenue, it has a crucial side effect: these data centers are consuming enormous tracts of viable industrial land. -

This collision of surging population growth and a data-center-driven land grab has created a severe supply-demand mismatch for flex space

Sky-High Demand: Demand for quality small-bay industrial and flex space dramatically outstrips the available supply.

Ultra-Low Vacancy: In key submarkets like Spotsylvania and Hanover, the light industrial vacancy rate remains below 2%. For comparison, the national average for small-bay is already a tight 3.4%.

Soaring Rents: With limited options, tenants are competing for space, driving warehouse rental rates up over 17% year-over-year.

Under-Built Asset Class: Developers often prioritize building massive "big box" industrial parks, leaving flex space a chronically under-built and underserved segment of the market.

This powerful combination of factors makes the I-95 corridor the most compelling market for flex space in the Mid-Atlantic.

Exploring Other Key Submarkets

While the I-95 corridor is the current hotbed, the DC-Richmond region has other established flex markets.

Dulles Tech Corridor: Centered around Dulles International Airport in Loudoun and Fairfax counties, this area is a long-standing hub for technology companies, defense contractors, and aerospace firms. Its proximity to federal agencies and a highly educated workforce keeps demand for R&D and light manufacturing space consistently high.

Richmond's Scott's Addition: This historic neighborhood has transformed from a purely industrial zone into a vibrant, mixed-use community. Its classic brick warehouses have become highly sought-after flex spaces for breweries, creative agencies, artisan workshops, and tech startups looking for a unique, urban feel.

Leasing 101: Understanding Flex Space Leases

When you lease flex space, you'll most commonly encounter a Triple Net (NNN) lease.

What it is: In an NNN lease, the tenant is responsible for paying their base monthly rent plus their proportional share of the property's three main operating expenses (the "nets"):

N - Property Taxes

N - Property Insurance

N - Common Area Maintenance (CAM), which includes things like landscaping, parking lot maintenance, and security.

Why it's used: NNN leases are standard for industrial and flex properties because they provide the landlord with a predictable, passive income stream while giving the tenant more control over the property's upkeep and costs.

Less common is a Modified Gross (MG) Lease, where the tenant pays a single base rent, and the landlord covers most operating expenses. This is more typical in traditional office buildings.

Who Thrives Here? Profiles of Ideal Flex Space Tenants

The beauty of flex space is its diverse tenant base. The demand is fueled by a wide range of businesses that are the backbone of our economy.

Local Trades & Contractors: Plumbers, electricians, HVAC technicians, and construction companies who need space for vehicle fleets, equipment storage, and a small administrative office.

E-commerce & Last-Mile Delivery: Businesses that need a local hub for storing inventory and dispatching deliveries to capitalize on the region's population boom.

R&D and Light Manufacturing: Tech firms, labs, and small-scale assembly operations that require a mix of office, testing, and production space.

Service Industries: Restoration companies, commercial cleaners, and event rental businesses.

Consumer-Facing Businesses: Fitness studios, breweries, ghost kitchens, and specialized training facilities that benefit from the open warehouse space and customer-facing office/showroom.

Your Opportunity in the Corridor Awaits

The market dynamics are clear: the DC-Richmond corridor, particularly around Fredericksburg, presents a rare and compelling opportunity. A structural and long-term trend of data growth is fueling a land rush that puts immense pressure on an already undersupplied flex space market.

Whether you are a business owner looking to expand or an investor seeking a high-performing asset, the time to act is now. But navigating this competitive landscape requires expert guidance.

Ready to find your competitive edge in the DC-Richmond corridor? The team at 1776 CRE has the deep market intelligence and relationships to secure your perfect flex space. Contact us today to get started.